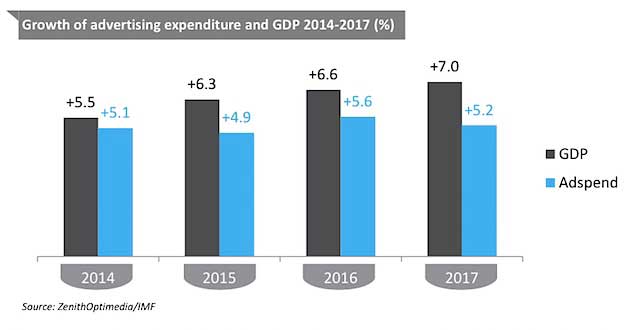

全球广告spend will increase 4.9% in 2015 and total $545 billion,according torecent projections fromZenithOptimedia, which expects the growth based primarily on an anticipated rise in overall global GDP in 2015.

However, the 2015 increase is projected to be slightly less than 2014's 5.1% because of a lack of major events such as the Winter Olympics, men's soccer World Cup, and midterm elections in the United States.

ZenithOptimedia项目a 5.6% global increase in advertising spend in 2016, thanks to the Summer Olympics, US Presidential elections, and UEFA European Football Championship.

Spend growth is expected to slip back to 5.2% in 2017 in the absence of such events.

Below, additional key findings from the forecast.

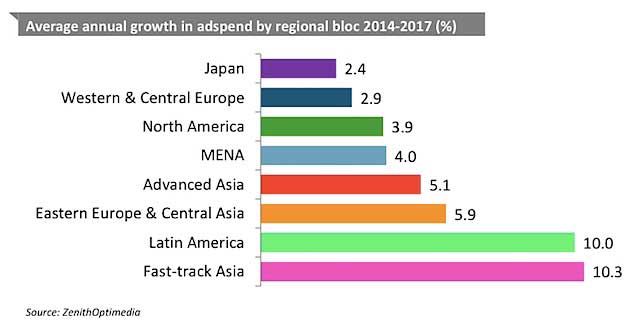

Ad Spend Projections by Region

Some key regional ad spend projections fromthe reportare as follows:

- North America: In the absence of the Winter Olympics and US midterm elections, ad spend is expected to grow 3.8% in 2015, followed by a jump to 4.1% in 2016 (thanks to the Summer Olympics and the Presidential elections in the US) and growth of 3.7% in 2017.

- Western and Central Europe: Growth in the United Kingdom and peripheral Eurozone markets is expected to counterbalance the weakness in the core Eurozone, leading to a projected average increase of 2.9% a year through 2017.

- Fast‐track Asia: This group of rapidly growing countries (China, India, Indonesia, Malaysia, Pakistan, Philippines, Taiwan, Thailand, and Vietnam) registered a 10.1% jump in ad spend in 2014. Similar growth of between 10% and 11% a year is forecast for 2015 through 2017.

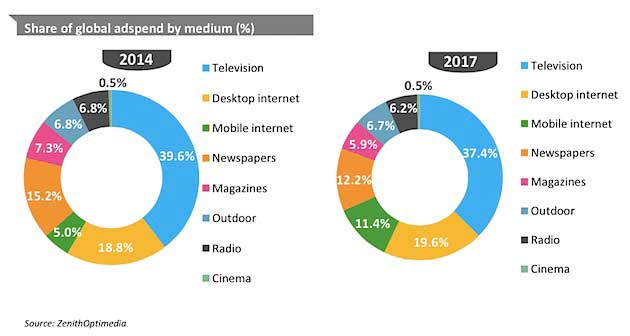

Growth and Share by Advertising Channel

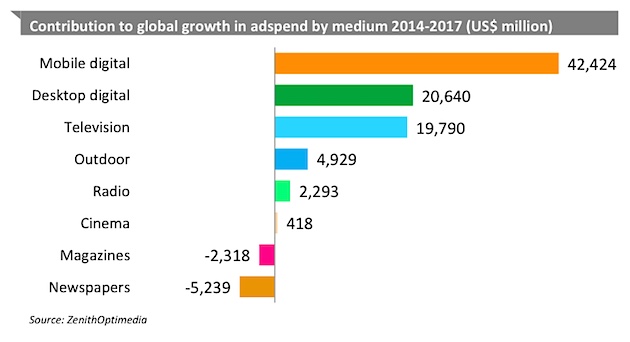

- Mobile is expected to be the biggest driver of global advertising growth, contributing 51% of all additional spend between 2014 and 2017 (excluding markets where ZenithOptimedia doesn't have a breakdown by medium).

- Desktop Internet is projected to be the second largest contributor (accounting for 25% of new ad expenditure), followed by television (24%).

- Newspaper and magazine ad spend is expected to shrink a combined $8 billion over the forecast period.

- Despite healthy growth, television’s share of global ad spend is expected to fall slightly over the next few years as desktop and mobile Internet grow much faster.